Authors: @Moss & @eek637 from Avantgarde Finance

We would like to kick off this Phase 1 Temp Check with our full support for the initiative that Radicle is taking towards a more active and forward-looking treasury management, as clearly outlined in these two posts (Link 1 Link 2).

We support the formation of a Strategic Treasury Management Working Group and also the ideas of diversification among crypto assets, Real World Assets RWAs and more importantly the idea of programmatic risk management and long-term vision for the treasury, rather than short-lived proposals that do not create a long-lasting value for the DAO.

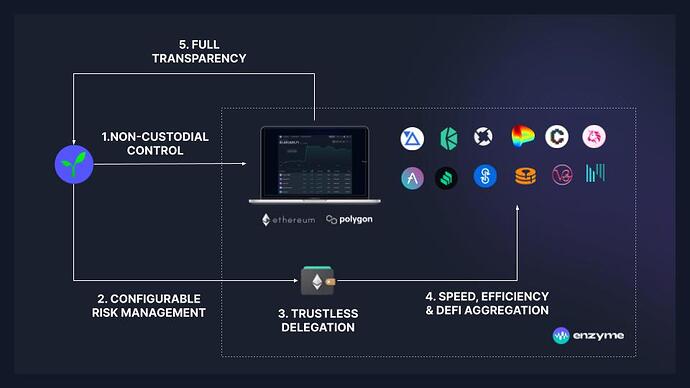

The key question this temp check want to address is: how do you enable an effective delegation (fast and efficient) while ensuring that strict risks policies are programmatically enforced (i.e. the DAO sets detailed management permissions) and that the delegation remains 100% trustless (i.e the DAO remains in control over the funds at all times)?

We believe that Enzyme is the best solution for this specific complex challenge, as it allows the DAO’s multisig to create and own a non-custodial DeFi vault, define the delegation rules and enforce them in the smart contract, letting the delegated manager operate within a “safe playground” and lastly maintaining a firm oversight thanks to a fully transparent 24/7 on-chain track record and a complete log of all vault transactions.

We also believe that using Enzyme is a future-proof solution for Radicle to implement its strategic treasury management framework, however it may evolve over time.

A few key elements to highlight:

-

Enzyme’s product roadmap includes RWAs, ability to perform DAO2DAO swaps, and also investing in other asset classes that are uncorrelated to crypto, which is in 100% in line with Radicle’s strategic goals.

-

Avantgarde (core contributors to Enzyme) can wear several hats: we can act as trustless delegated treasury manager, governance advisor and Radicle can also leverage our DeFi development arm to add new features as and when required.

-

The management delegation could be optionally delegated to Avantgarde but it may well be assigned to one (or more) members of the newly formed Strategic Working Group.

-

The Radicle DAO could easily assign / revoke multiple delegations (e.g. different members of the Working Group) all of which could have different levels of trading permissions (i.e. flexible level of granularity)

For more insights, we kindly ask you to watch the recording of the recent community demo we gave on July 28th. You can find the link to the recording here.

For all the reasons outlined above we believe Enzyme is well equipped to serve Radicle’s current needs as well as its future evolving requirements.

We’re excited to collect your feedback and continue this conversation in order to present the best possible proposal during the next phases of this governance process.