Intro

Based on recent discussions on Discord, it has come to my attention that the Strategy Committee is actively exploring and discussing different ways how Radworks can approach treasury sustainability throughout 2024. In light of this, I am keen to present an innovative proposal on achieving this objective by employing so-called covered call strategies.

Idea

The idea is to leverage a portion of Radworks treasury for covered call lending. This approach involves lending out a smaller part of currently idle $RAD tokens. By doing so, Radworks can generate significant upfront revenue in USDC. The earned USDC can be immediately utilized for community needs. And unlike a simple token sale, covered call lending enables the treasury to diversify its holdings into stable assets without an immediate market impact.

Benefits

• Idle $RAD tokens can be used to generate upfront USDC revenue

• Immediate revenue and liquidity for operational and developmental activities

• Diversification of the treasury into stables

• Tokens don’t need to be sold, thus there’s no immediate market impact

Example Scenario

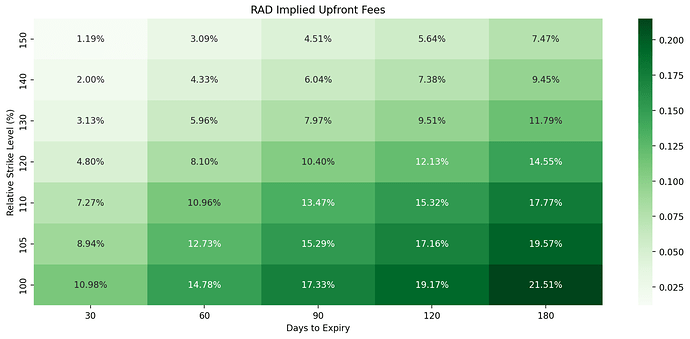

The diagram below shows indicative upfront premiums (as of 16. January 2024) that the Radworks treasury could earn across various loan duration (Days to Expiry) and upside cap (Relative Strike Level) combinations.

For instance, Radworks treasury lends $100k worth of $RAD for 90 days at a 110% upside cap. In turn, Radworks treasury gets approx. $14k USDC upfront.

If the $RAD price remains below 110% after 90 days, the originally loaned $RAD is returned. If it exceeds 110%, Radworks treasury receives $110k USDC (and still keeps the initial $14k USDC upfront).

Conclusion

This proposal outlines how the Radworks community can generate USDC cash revenue by using idle $RAD treasury for covered call lending. This approach not only diversifies the treasury but also avoids market impacts that could arise from outright selling $RAD tokens. I’d love to hear the community’s thoughts on this idea and more than happy to outline a detailed draft.