Summary:

This post outlines a framework for the Radicle Treasury as a means to grow and nurture the Radicle Ecosystem. There has been much recent discussion on treasury management and how best to deploy and utilize the Radicle Treasury. This post is an attempt to synthesize these discussions, and to provide additional context on what the Radicle Treasury is and what its objectives are. Additionally, we share some initial ideas on how to deploy, operate, and manage the treasury. There’s a large number of cool things for the treasury to work on, and we think it’s time to formalize these discussions and processes. This is not meant to be an exhaustive post, and we welcome any and all feedback and suggestions from the community!

Who we are

Myself and Larry are the founders of Reverie, an organization dedicated to helping DAOs scale and operate more effectively than traditional companies. We’ve been deeply interested in crypto-governance and open-source funding for many years, and have been working full-time in the crypto space for the past five years, including participating in governance of numerous projects such as Compound, Uniswap, and others. In my past life I was a crypto investor and researcher at Blockchain Capital, while Larry was an investor at Digital Currency Group.

Background on Radicle Treasury

What is the Radicle Treasury?

The Radicle Treasury is a community owned and governed pool of capital that can be used to develop and grow the Radicle network and community. Using the financial firepower provided by the treasury, Radicle’s community of tokenholders can propose, vote on, and implement initiatives that make Radicle a core piece of internet infrastructure.

As detailed in a recent post, Radicle has been primarily developed by a core team of contributors supported by the Radicle Foundation and (previously) Monadic. While the Radicle Foundation will continue to fund contributors in the very short term, in the medium term, the Treasury will be the main pool of capital that will be deployed by the community to fund development of the Radicle project & ecosystem.

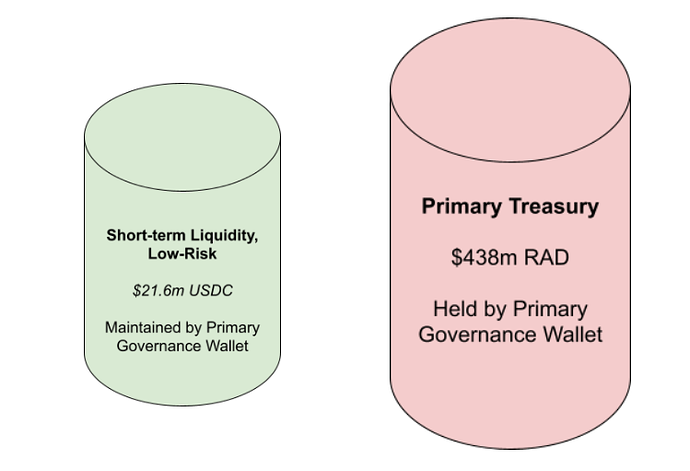

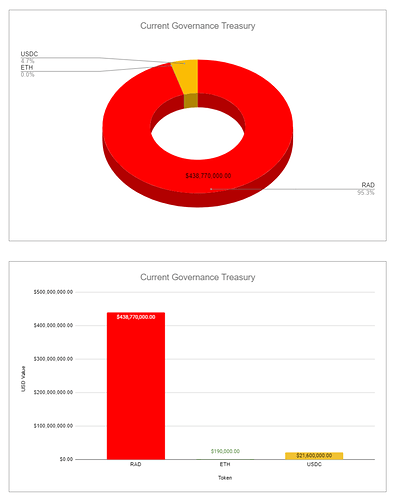

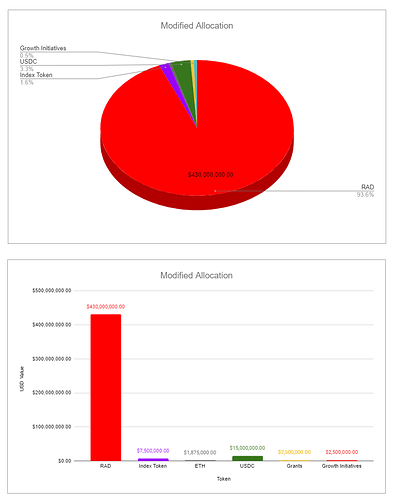

How large is the treasury?

The Radicle Treasury currently holds 51.6M RAD tokens and 21.6M USDC. At current prices, this amounts to approximately $300M+ — a significant pool of money that the community can use to build powerful things. The source of these funds is the genesis allocation and proceeds from the Radicle Liquidity Bootstrapping event.

- Genesis Allocation (50M RAD)

- At genesis of the RAD token, 50% of the RAD supply (50M RAD) was allocated to the community treasury. At current prices, the genesis allocation comes out to roughly $300M.

- Radicle Bootstrapping (1.6M RAD, $21.6M USDC)

-

In February 2021, Radicle conducted a Liquidity Bootstrapping event designed to distribute the token to the broader community. Of the 3.75M tokens allocated to the sale, 1.9M were sold to raise $24.7M USDC from 1,859 contributors.

-

Per Radicle governance proposal 4, the remaining Radicle tokens and USDC raised were transferred back to the community treasury. Ultimately, this amounted to 1.7M RAD and $21.6M in USDC.

What should the treasury be used for?

There is no shortage of things for the treasury to fund. To help the community find funding priorities, it’s helpful to review the goals of the Radicle project.

What are the goals of the Radicle project?

Radicle’s main goal is to provide a robust platform for code collaboration on the internet. To this end, success for Radicle can be defined by how many projects leverage Radicle’s neutral, robust infrastructure for sustainable, collaborative, and trust-minimized development. Thus, success can be measured by the breadth and depth of developers and users building on top of Radicle’s infrastructure.

A recent post on Radicle’s 2021 objectives lays out objectives for the next year. Broadly speaking, improvements and progress can be segmented under two main categories: Product and Community.

Product

- Development of the core Radicle stack

- Applications built on top of Radicle` to facilitate effective collaboration experiences

- Maintenance of a healthy and resilient p2p stack

- A low-friction, accessible Radicle experience

Community

- Active set of contributors improving and maintaining core infrastructure

- Developers building on top of Radicle stack

- Active and engaged governance participants

Deeply understanding these objectives can help the community align itself and decide what to work on.

How can the treasury be deployed?

Receiving RAD or USDC from the treasury should not be a difficult process, as that would prevent contributors from applying for funding. At the same time, it shouldn’t be too easy to receive funding from the treasury either, as that would result in its abuse. Balancing these two conflicting points is necessary.

A simple and effective approach to balancing these two points is to allow contributors to apply for funding in two ways:

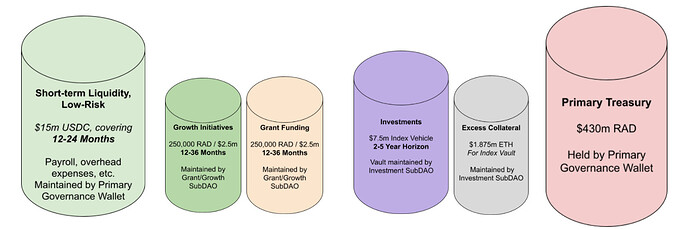

Grants program (<$250k)

Grants programs are a proven way to quickly get funds from the treasury into the hands of contributors. Here’s how they typically work: a group of trusted community members come together to form a grants program which then receives funding from the treasury via a vote by tokenholders. These funds are held in a multisig controlled by trusted community members. When contributors need funding, they can apply to the grants program. The grants program is best used for smaller, sub-$250k grants; larger funding requests are best done through a tokenholder vote in order to give tokenholders a say on major treasury expenses.

Tokenholder vote ($250k+ or continuous)

Requests for a large amount of funds ($250k+) are best done through a tokenholder vote. As briefly mentioned above, the intuition behind this approach is to allow tokenholders to express their opinion on large expenses incurred by the treasury. While this process is more time-consuming than a grant from the grants program, this delay serves as a feature rather than a bug: it allows the community to review the funding request, process it, and come to an independent conclusion without being rushed.

In creating two entrances into the treasury — a grants program and tokenholder vote — Radicle is able to get the best of both worlds: it can fund smaller grants rapidly and allow for larger fund requests through a more rigorous governance process.

As the treasury grows in size, it will make sense to recalibrate the admission sizes for the grants program and the tokenholder vote. For example, if the Radicle Treasury grows 10x in size, it’s likely the grants program mandate will expand from <$250k to a larger amount.

Ideas for early treasury uses

Since there are an incredible amount of things a treasury can be used for, it’s sometimes difficult for communities to know where to begin. To help the community start tapping into the treasury, we highlight several ideas that serve as initial use-cases.

- Radicle Grants Program (RGP)

- Why: provide a quick source of funding to individuals and teams looking to work on specific initiatives.

- How: allocate $1-2M from the treasury to a trusted group of Radicle community members to allocate funds over 3-6 months.

- Benefit: empowers the community by funding development, governance participation, marketing, design, and growth.

- Examples: Uniswap Grants, Compound Grants, and Aave Grants.

- Growth Initiatives

- Why: provide incentives to drive certain user behaviors, engagement, and growth.

- How: launch an incentive program to encourage teams to use Radicle.

- Benefit: grow usage of Radicle.

- Examples: Uniswap Liquidity Mining and Balancer Governance Mining.

The two ideas above aren’t meant to be exhaustive; rather, they’re there to show the community two early examples of what the treasury can be used for today. We welcome any feedback or suggestions on other treasury use cases - there are many of them!

Conclusion

Radicle’s treasury is an incredibly important asset that’s owned and governed by RAD tokenholders. Using it productively can turbo-charge Radicle’s growth by providing funding to users, contributors, and partners.

Things are still early for Radicle Governance and there’s lots of opportunity to get involved for anyone that is interested. Governance is an open forum: anyone can contribute feedback, ideas, or suggestions on new initiatives.

We’re interested to hear your feedback on the proposed ideas, and on any other suggestions or best practices for the treasury, or governance more broadly. Governing a DAO’s treasury is a difficult task, and should be a process done with feedback from a broad set of community stakeholders. In particular, as ideas bubble up from the community, we think it makes sense to set up workstreams focused on specific areas (e.g., marketing, growth initiatives, treasury management). To this end, we think it makes sense to create a “Governance Working Group” that can meet regularly to discuss all things Radicle Governance, including treasury management. We will share more thoughts on this concept in a future post.